From January 1st, 2026, Nigeria is set to revamp its tax collection framework as part of ongoing reforms aimed at improving compliance, transparency, and government revenue. These changes affect both businesses and individuals, with stronger emphasis on data integration across agencies, and stricter enforcement by relevant tax authorities.

As a result, the tax net has been widened, making it difficult for businesses, formal or informal, to operate outside the tax system.

Before now, Nigeria had two different tax bodies issuing different Tax Identification numbers (TIN); the Federal Inland Revenue Service (FIRS) and the Joint Tax Board (JTB). In the new dispensation, only one entity is authorised to issue Tax identification numbers; the newly formed Nigerian Revenue Service (NRS).

What does this mean for Nigerian Businesses?

Businesses in Nigeria need to generate a new Tax Identification number or Tax ID. Even if you previously had a TIN from either FIRS or JTB, you need to generate a new TIN as the old numbers are no longer relevant.

In the coming days, banks and other financial institutions may create a portal for businesses to link their new Tax identification numbers to their bank accounts.

Newly registered businesses will be required to generate a tax identification number and provide this number when registering a business bank account.

The abbreviations Tax ID (TID) or TIN may be used interchangeably but they mean the same thing.

How to Generate Tax Identification Number or Tax ID

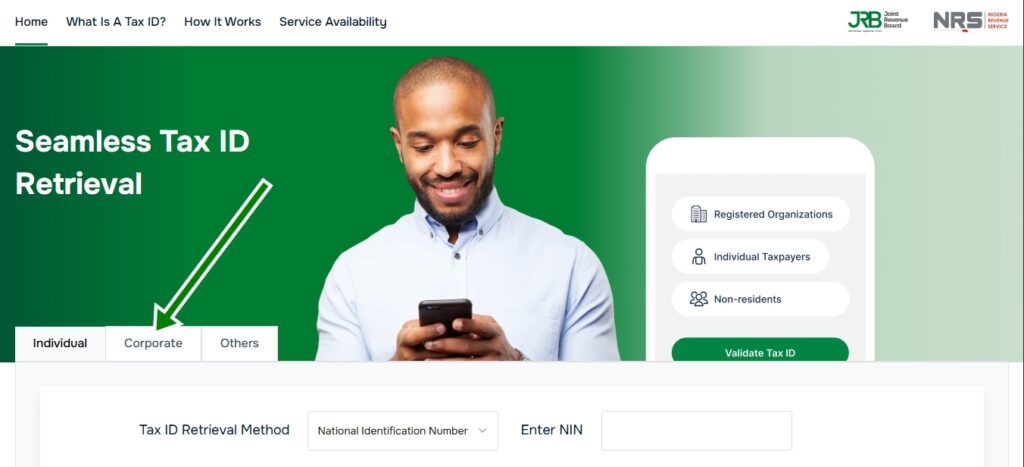

Visit the NRS TaxID retrieval portal here.

Select corporate if you are generating for your business.

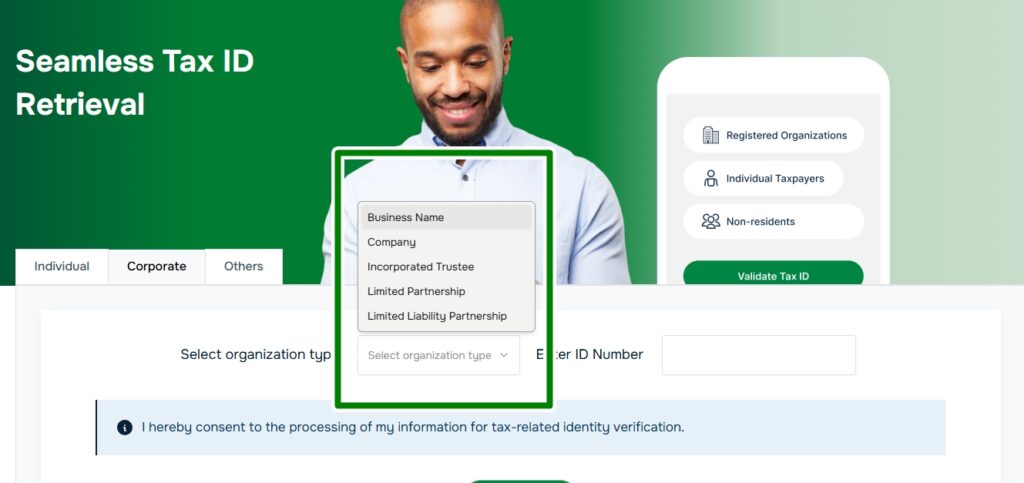

In the organisation type options, choose your business type. You can know your business type by looking at the text before the number on your business CAC certificate. The most common business types in Nigeria are Business names, Company or Incorporated Trustees.

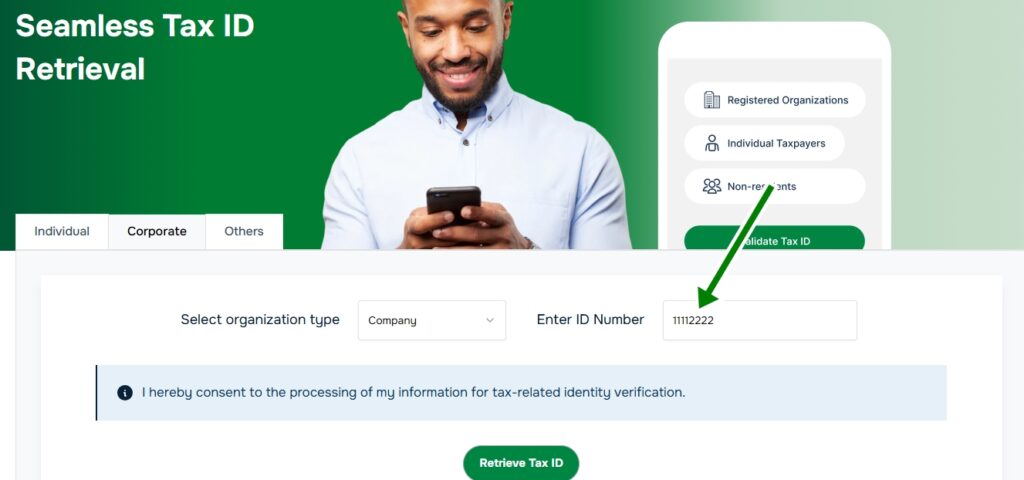

Enter your ID number in the appropriate box. Your ID number is your business registration number. Only type the number, do not include RC, BN or IT.

Click on retrieve Tax ID.

If done correctly, your Tax Identification number or Tax ID will appear. Copy this number and save it on a notepad.

You can also use this same portal to generate a Tax ID for yourself. Simply select individual, enter your National identification number and click on retrieve Tax ID.

You will see a pop-up requesting for your first name and last name; enter them as they appear on your NIN slip. Also enter your date of birth.

Note that the date of birth entered must be similar with what is available on the NIN portal.

Tick the consent box and click on submit.

Unlike the JTB TIN that comes with a PDF certificate that can be printed, the new Tax ID will only be displayed on the NRS page after retrieval.

Financial institutions like commercial banks, Microfinance banks and Fintech apps will request for this number just like they request for Bank verification numbers (BVN).

Agencies like the EFCC that usually request for TIN certificates during SCUML registrations will also make adjustments.

Now that you’ve gotten your Tax ID;

Include narrations in transactions

Adding narrations to every transaction you make in your business bank account might not be compulsory but it will help you understand the purpose of each transaction during tax filings

Treat your business bank account as a separate entity

Your spouse called you by 8PM to get bread while coming home, you dash to the nearest grocery store, logged in to your personal account, there’s no money there. You have forgotten that you paid your mechanic ₦120,000 to fix your car and sent ₦70,000 to mama during the week.

You log in to your business bank account, there’s 7 million Naira there; Bread is just ₦2,000. Don’t do it. Call your spouse to borrow you.

Work with a Tax Auditor

Hire a Tax Auditor to audit your account statement before filing. This way, you are sure to pay the correct amount in taxes. If the tax authorities come to carry out an audit by themselves and they find some discrepancies, your tax auditor can defend your filings and help negotiate penalties or adjustments.

FAQ

How long does it take to generate a Tax ID or TIN?

Generating a tax ID is instant.

Is it Compulsory I Generate a Tax ID for my Business?

Yes, it is. Without a Tax ID or TIN, you cannot operate a bank account for your business.

How Much Does it Cost to Generate a Tax ID?

Generating a Tax ID is completely free.

Does Having A Tax ID Mean That The Government Can Automatically Deduct Money From My Account?

No, the only deductions that will happen automatically are the usual stamp duty charge and your bank’s account charges like SMS, transfer fees, and account maintenance charges.

Is There A Deadline For Generating Tax ID

There’s no deadline as the portal will remain open.

Thank you for reading our article on how to generate a Tax ID for your business. Also read our article on how to open a business bank account.

Did you find this article helpful? Kindly share it using the share buttons below.