While there are several banks in Nigeria, not all are optimised for growing businesses. Each bank has its strengths and limitations – therefore, choosing a bank account can make or mar your business.

In this article, you will learn about what to look out for when choosing a bank for Small and Medium Enterprises in Nigeria and how to choose which one to bank with.

What to Look out For When Choosing an SME Friendly Bank

SME support

No organisation can be good at everything. In 2011, Google, the popular search engine company, tried to delve into the Social media networking business after the success of Facebook by launching Google plus.

It gained some initial traction but Google plus failed and Alphabet shut it down.

This wasn’t Google’s first attempt into Social Networking. It launched Orkut in 2004, which was eventually discontinued a decade later. It also introduced Google Buzz in 2010, but that was also shut down within a year.

So it is with Banks. There are so many aspects to banking and no one bank excels at everything.

When choosing a bank for your business, choose a Bank that has shown commitment to supporting SMEs through accessible low interest loans, tools and SME-focused initiatives e.g business training.

Network Availability

Trust is a big factor in business. In a low trust society like Nigeria, a bank with consistent network failures can ruin your business.

Customers want to receive value for what they paid for immediately after payment. If it takes several hours for your business bank account to receive credit from other banks, you will lose customers’ trust, delay order fulfillment and potentially hurt your business reputation.

Opay has a reputation for fast transaction processing to any bank in Nigeria. Imagine a customer sends money from an Opay account to your business account and twelve minutes later, you are yet to receive the funds. Some customers would think you are lying or trying to be funny.

POS

Depending on the kind of business you are into, having a POS device might come in handy. There’s still a fraction of customers that prefer to pay with cards, you don’t want to miss out.

It’s best to choose a bank that offers reliable POS services with fast settlement time and fair transaction fees.

We also recommend that your POS device should be from the same bank you’ve chosen to open your business account with. Using a device from a different bank makes transaction reconciliation more complex.

Branches

Although a lot of customers pay with card and bank transfers, there’s a big number that prefer to pay with cash – especially in certain regions or older demographics. For this reason, it’s important to choose a bank with a large branch network, so you can conveniently manage cash payments and reduce the risk of holding excess cash on-site.

Web and Mobile Banking tools

If you are asked to choose between visiting your bank branch or using internet banking to download your statement of account, which option would you choose? I bet you would choose to do it via Internet banking.

Why spend hours visiting your bank to get a piece of paper when you can get the same piece of paper from the comfort of your office?

When choosing a bank to operate your business account with, choose one that lets you do more from your phone or computer.

Customer Service

Customer service is one of the most underrated factors when choosing a bank for your business. As an SME, there will be times when you need quick resolutions to problems like a failed transaction, a delayed alert, or a need for account clarification. A bank with responsive, knowledgeable, and easily accessible customer support can save you from stress and unnecessary delays.

Look for banks that offer multiple support channels (phone, email, live chat, and in-branch assistance). Some banks also assign dedicated relationship managers to business accounts, which can be a huge advantage when handling more complex issues.

How to Choose a Bank for your Business

This will take you some time of research but it is totally worth it.

Ask Gemini to help

Banks and other financial institutions like to publish their SME initiatives on popular media outlets. Instead of manually checking each media website, you can tell Google Gemini to do this for you by using the prompt below.

Open Gemini AI in a new tab.

Then type in this prompt

“Hi Gemini, I need you to search popular media outlets for publications by commercial banks in Nigeria on supporting SMEs with loans and SME programmes.

With this information, form a list of 5 banks you think I should open my business account with.”

Gemini will search the web and show a list of banks that have been in the news for supporting SMEs.

Leave the tab open and proceed to the next step

Check Number of Branches

If a bank does not have much presence in the state where you do business, it could be a sign that the state isn’t a top priority for them. This might translate to less support for businesses within the state.

In the previous chat with Gemini, enter the prompt below to see how many branches each bank has in the state your business is located.

“Which of these banks have the most branches in [enter state where business is located].

N.B: If your business is located in Lagos and Abuja, you can ignore this step.

Pick 2 or 3 banks with the highest number of branches within the state.

Confirm Network Availability

To confirm if the remaining banks on your list have a consistent and reliable network to receive payments from customers, there are two options to choose from;

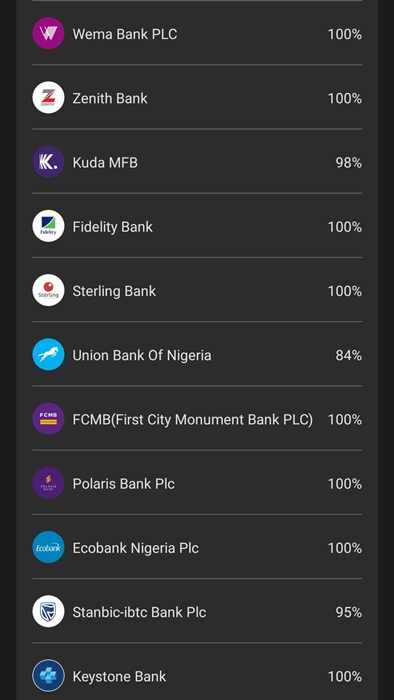

Check Opay Bank Transfer Success Monitor Tool

Opay has a tool for monitoring bank transfer success rates. From this tool, you can see the list of banks that are performing poorly at the time you checked.

If you have an Opay account, you can use this tool to monitor the banks remaining on your list for at least 3-7 days to ensure a stable network.

Open the Opay app and click on bank transfer. Locate bank transfer success rate monitor to view the performance of each bank in Nigeria.

Ask POS operators

If you don’t have an Opay account, you can ask POS operators to give you a list of banks with terrible networks. These operators deal with multiple banks daily and can quickly tell you which ones frequently experience transaction delays.

Once you get this list, cross-check to confirm that none of the banks remaining on your shortlist are on it.

Conclusion

Choosing the right bank for your business in Nigeria goes beyond just opening an account—it’s about finding a financial partner that aligns with your goals, understands the challenges of SMEs, and offers the tools you need to grow.

While no bank is perfect, some clearly stand out in terms of supporting small and medium-sized businesses. Take time to assess your business needs, compare the options available, and speak to fellow entrepreneurs in your industry. The right banking partner can make a significant difference in your business success.

Thank you for reading our article on how to choose the best bank for your business, you can also read our article on how to file annual returns on the CAC portal and how to register a trademark in Nigeria.

If you enjoyed this article, kindly subscribe to our WhatsApp channel to get notified when we publish new articles that will help grow your business.